Mobile Deposit

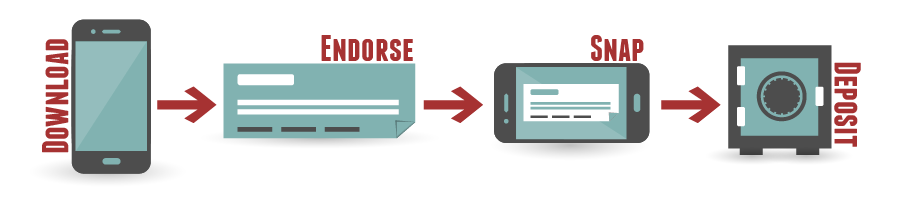

Make your deposits right from your mobile device!

Save time by conveniently depositing your check by using our mobile app.

How it Works

Enroll

- You will first need to have an Online Banking ID. If you do not have an ID, click the login button and select "Enroll"

- Download our Mobile App

- Login to our app and select "Deposit Checks" from the menu.

- Complete the information requested from the app.

- You will receive a secure message notification from us once you have been approved.

Let's make a deposit!

- Login to our app and select the "Deposit Checks" from the menu

- Select "Make a Deposit"

- Enter the amount of the check to be deposited

- Select the account into which you are making a deposit

- If you have not already done so, please endorse your check and include the phrase "For Mobile Deposit Only" along with your account number.

- Select "Take Pictures" to activate your phone's camera. Snap a photo of the front and back of the check.

- Press "Submit" and you will see an alert stating that either your deposit has been submitted or rejected. If you deposit was rejected please see the FAQ for tips on getting a quality check image or other troubleshooting steps.

- You will receive a confirmation email stating that your deposit has been accepted.

- Place the check in a secure place so that it is not mistakenly deposited again. You can write "VOID" across the front of the check once the deposit appears on your statement and it can be destroyed after 60 days.

- You're done!

FAQ

What types of items can I deposit?

- Most paper checks can be deposited as long as they do not exceed your accounts daily or monthly limits.

What types of items cannot be deposited?

- Foreign checks, bonds, 3rd party checks, returned or re-deposited items, and rebate checks are not eligible for mobile deposit.

Are there limits on my deposits?

- Yes. Select "Make a Deposit" and click the "Deposit Limits" info button to view your current limits.

Can I increase my limit?

- Yes. Please call (800) 391-2535 to speak with a bank representative about increasing your mobile deposit limits. Alternatively, you can select the "Request Changes" option under the deposit menu to send a secure message to us. Your account must be in good standing and additional fees may apply.

I've been approved for Mobile Deposit, but the deposit account I want to use is not listed?

- Select "Deposit Checks" and select the "+Enroll Another Account".

- If the account you would like to add is not listed, Please call (800) 391-2535 or send us a secure message from the app and we'll get your account added.

What if I don't see the Mobile Deposit option on my menu?

- Verify that you have the latest version of our app from iTunes or Google Play app store.

When will I have access to the funds after I have completed my deposit?

- Funds for mobile deposits made on business days before 3:00 p.m. (Monday through Friday, excluding holidays) will normally be available after our end of day processing. Funds for mobile deposits on business days after 3:00 p.m., weekends, and holidays will be available at the end of the following business day. See our Mobile Funds Availability Policy for details.

Why was my deposit rejected?

- Read the rejection message carefully to determine the issue with your deposit

- Verify that you endorsement is present and that the exact words "For Mobile Deposit Only" are clearly printed below your endorsement.

- Ensure all four corners of the check are visible and inside the guide lines while snapping your photo.

- For very wide checks, try to center the image within the guides for best results.

- Place checks on a dark surface with good lighting and keep the check as flat as possible.

- You may have exceeded your account limits for Mobile Deposit.

- Ensure the check amount entered matches what has been written on the check.

- You may have already deposited the item. Review your transaction history to determine if the item was already deposited.