FAQs

Online Banking FAQs

After how many invalid logon attempts will I be locked out of Internet Banking?

Three invalid logon attempts will lock you out of Internet Banking. Click the "Forgot?" link to reset your password. Customers can also call a customer service representative at 800-391-2535 Monday through Friday from 8:00 am – 5:00 pm and Saturday 8:00 am – Noon. You may also send an email notification using the contact us links on our website. Remember, do not send any personal information – passwords, account numbers, social security numbers, etc – when communicating through email.

Can I use Internet Banking if I only have a CD, Loan, or Savings Account?

Yes. If you have any First State Bank of Purdy account - CD, Loan, Savings, or Checking product - you can get Internet Banking for FREE. You must have a checking account to have Bill Payment.

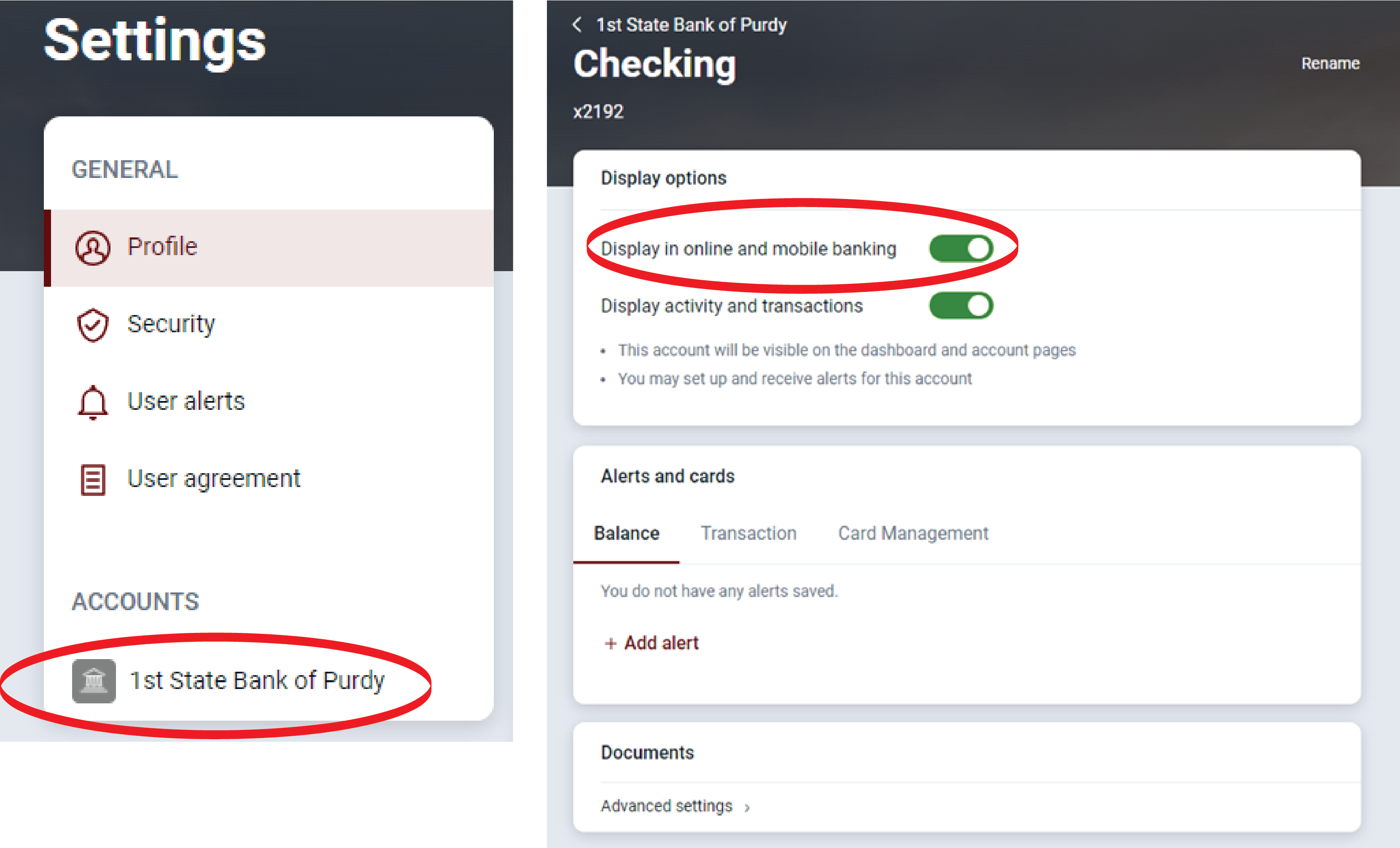

How can I add, delete or hide an account from Internet Banking?

To add or delete an account from your online banking, contact any customer service representative. Accounts can also be hidden from view on your online banking. Select your profile settings and choose "1st State Bank of Purdy" from the Accounts section. From here choose the account you would like to hide and toggle the display option.

How can I reset my Internet Banking Account (not Bill Payment)?

Click the "Forgot?" link to reset your password. You can call a customer service representative at 800-391-2535 Monday through Friday from 8:00 am – 5:00 pm and Saturday 8:00 am – Noon. You may also send an email notification using the contact us links on our website. Remember, do not send any personal information – passwords, account numbers, social security numbers, etc – when communicating through email.

How can you guarantee the security of my banking information?

First, we use industry-standard encryption to secure your Internet Banking sessions. Whenever you see the padlock symbol in your browser, you know this security feature is active. Other security tools are in place to ensure the integrity of your data, including firewalls and filtering routers that secure computers from Internet access and a "trusted" operating system, which protects information from both internal and external threats.

For additional security, customers select their own password. Password guessing is deterred by locking the ID out of the system following three unsuccessful logon attempts. In addition to password selection, customers are also required to setup two-factor authentication.

These are just a few of the many security tools we use. These layers of security work together to make sure that all information transmitted between you and First State Bank is both secure and authentic.

If I have questions about Internet Banking whom should I call?

A customer service representative will be happy to answer your questions. After you have logged on to online banking, you may create a new conversation with us for a prompt reply during business hours. We can also be reached at 800-391-2535 Monday through Friday from 8:00 am - 5:00 pm and Saturday 8:00 am - Noon.

What do I need to gain access to Internet Banking?

User ID, password, and Internet access. The Internet access could be from home or work.

What does Internet Banking cost?

Internet Banking is free to all First State Bank of Purdy customers. For additional information, contact a customer service representative at 800-391-2535.

What happens if I lose or forget my ID or Password?

Click the "Forgot?" link to reset your password. You may also call a customer service representative at 800-391-2535 Monday through Friday from 8:00 am - 5:00 pm and Saturday 8:00 am - Noon.

What services are offered through Internet Banking?

- Unlimited number and types of account access.

- Transfer funds between all checking and savings accounts (regulatory limitations may apply).

- Make a loan payment by transferring funds from a First State Bank checking or savings account.

- Transaction history on all deposit and loan accounts.

- Check imaging with front and back images on cancelled checks.

- Obtain account information on your First State Bank checking, savings, CD, loan and safe deposit accounts.

- Stop payment on checks drawn on your checking account at First State Bank (stop payment charges may apply).

- Download "real time" transactions from any account to industry standard money management software.

- Bill payment option - access the designated checking account to pay bills

- eStatements - receive electronic statements directly through email or NetTeller

- Send secure messages to bank personnel with the "Start A Conversation" feature.

Will Internet Banking be available to me all the time?

It will be available virtually any time, day or night, 7 days a week. However, there may be times when it is temporarily unavailable due to nightly processing updates or technical difficulties.

What do I do if I replace my phone or can no longer access my two-factor-authentication method?

Call a customer service representative at 800-391-2535 Monday through Friday from 8:00 am - 5:00 pm and Saturday 8:00 am - Noon. We will be able to verify your information and reset your authentication method to allow you to enroll a new device.

How can I get Internet Banking?

Select Login from the website and choose the "Enroll" option. First State Bank customers can also start Internet Banking by visiting any of our branch locations or by completing the application that is available online.